Keep a low profile and seek victory in stability!

All the best trading leader gather in our community! Let's review their trading dynamics in last week!

Trading Leader Performance

Review

Snowball2024

【Snowball2024】 chose not to trade last week, instead retaining the positions from the previous week, and easily profited $127, temporarily ranking third on the earnings leaderboard.

Mr. Anchor

【Mr. Anchor】followed closely behind, with 9 trades in a single week and a 67% win rate, securing a profit of $150 and quietly taking second place.

xauusd07

【xauusd07】With 6 trades in a single week and a 50% win rate, achieved $226 in profit, becoming the champion with the lowest earnings in history.

Best Trading Leader

Best ROI

- -- %

Overall Profit

- $ --

Balance

- --

Subscribers

Position

Order Distribution

Assets

Order Revenue/ order($)

ROI

Trading Review

Looking at last week's trading data, many people might be curious: not only did the top-ranked player's profits fall short of expectations and remain at a relatively low level, but all participants collectively made a common choice: proactively reducing their positions and using less margin to trade. This seemingly unusual unified action actually reflects a precise judgment of the market environment, and the core reason is the highly anticipated US-China trade negotiations last week.

The progress and outcome of these negotiations remain unclear, bringing significant uncertainty to global financial markets. This uncertainty directly leads to increased asset price volatility and greater difficulty in trend prediction, meaning any one-sided bet may face unexpected risks. Faced with this market environment, top players have activated risk management modes, employing prudent strategies to cope with volatility.

The top-ranked [xauusd07] and second-ranked [Mr. Anchor] opted for a "double reduction" strategy. On one hand, they proactively reduced their trading frequency to decrease the chance of blindly trading in uncertain market conditions; on the other hand, they simultaneously lowered their margin requirements, controlling their capital exposure to mitigate risk. This way, even if their market judgments were subsequently flawed, they could avoid significant losses and steadily preserve their previously accumulated profits thanks to the limited margin requirements.

The third-ranked [Snowball2024] took a more intelligent approach, choosing to suspend new trades and rely solely on existing positions to weather market fluctuations. This "wait and see" strategy not only avoided new risks in uncertain market conditions but also preserved profits during volatility through precise early position planning, ultimately navigating the risky period and securing an excellent third-place finish.

Profile

ROI Volatility

Performance

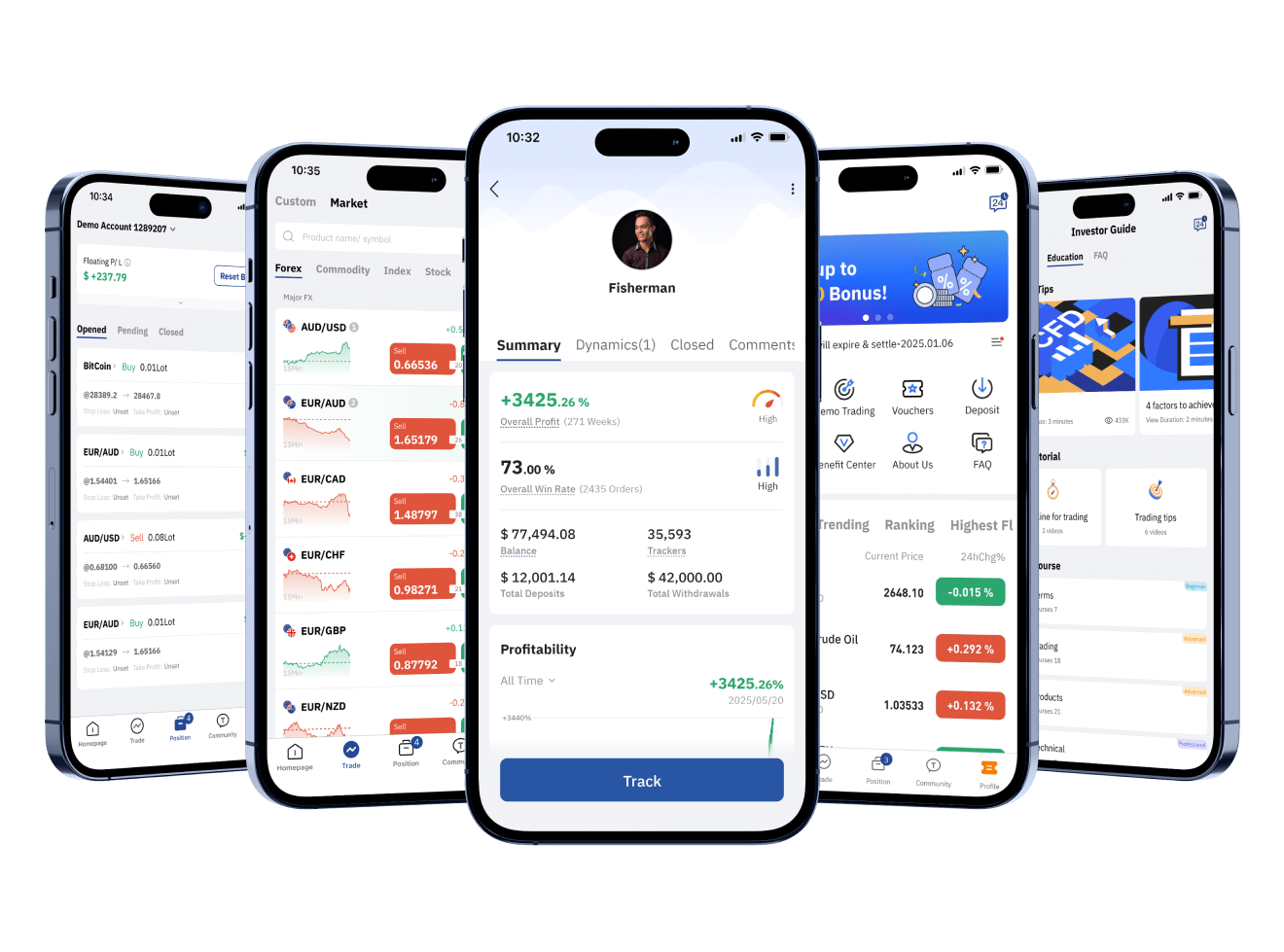

Want to earn profit just like them?

- Instant Position Update

- Copy their buy/ sell position

- In-sync trading profit

Download TOPONE Markets

Download TOPONE Markets

Get the most profitable trading signals first, 1 million traders have downloaded it, and the average daily profit opportunities exceed 200!

English

English