The winning streak ends, a new king is crowned!

All the best trading leader gather in our community! Let's review their trading dynamics in last week!

Trading Leader Performance

Review

xauusd07

【xauusd07】With 9 trades in a single week and a 56% win rate, barely secured $1007 in profit, becoming this week's 【Profit Star】.

Mr. Anchor

【Mr. Anchor】achieved a profit of $213 with 9 trades in a single week and an 89% high win rate, surpassing the top-ranked 【xauusd07】 in terms of data, but the position layout was slightly conservative.

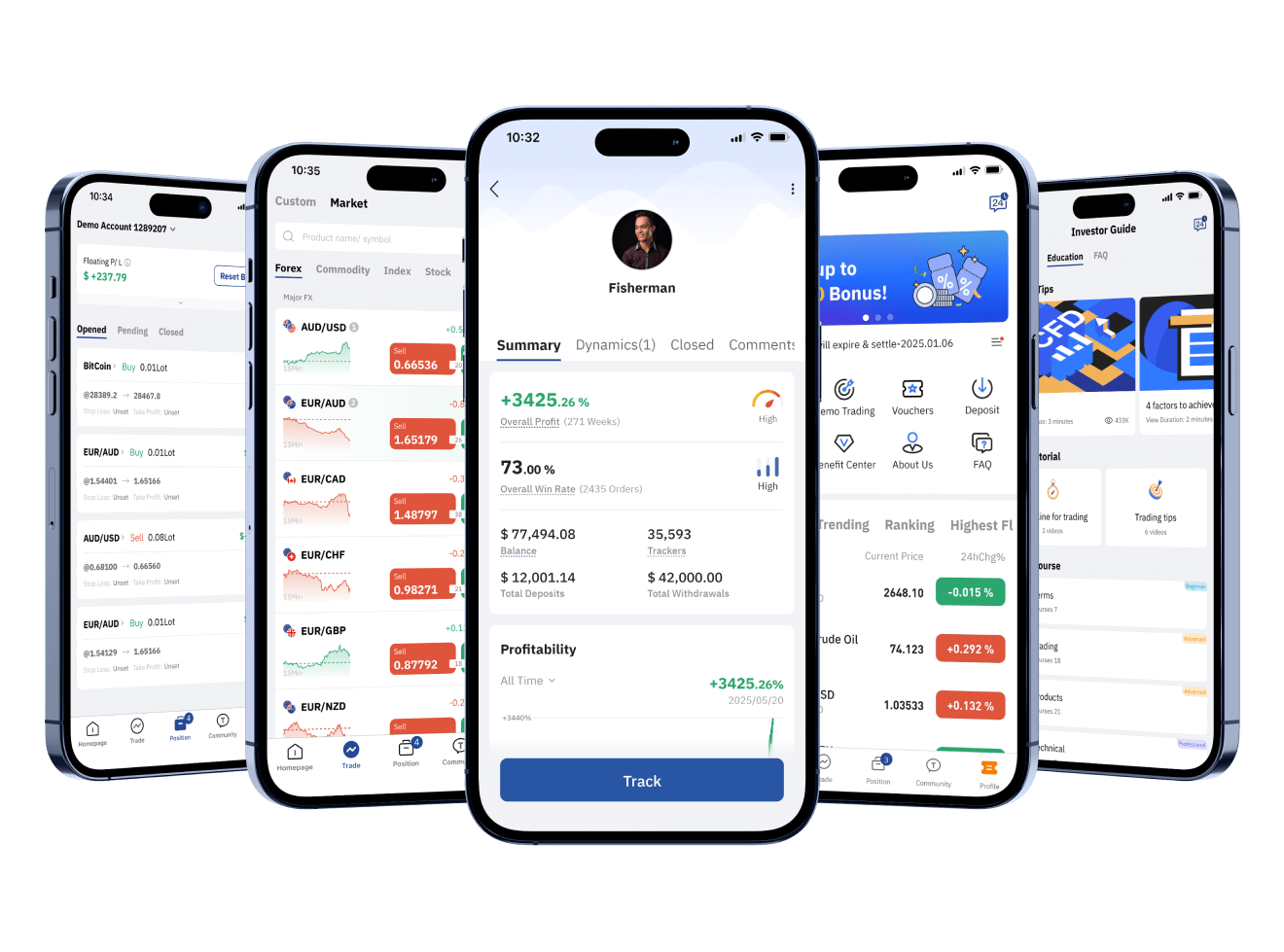

Fisherman

【Fisherman】With 11 trades in a single week, a 55% win rate, and a loss of $4509, the 【Fisherman】who had been at the top for four consecutive weeks finally fell this week, becoming the lowest-ranked player.

Best Trading Leader

Best ROI

- -- %

Overall Profit

- $ --

Balance

- --

Subscribers

Position

Order Distribution

Assets

Order Revenue/ order($)

ROI

Trading Review

This week's overall trading data showed a significant downward trend, falling far short of expectations. Among the participants, [xauusd07] and [Mr. Anchor] maintained their consistently stable performance, with trading rhythm and profitability remaining within normal ranges without significant fluctuations, making them one of the few stable bright spots in this week's data.

In stark contrast, Fisherman, who has consistently held the top spot in the player rankings and is considered an "ever-victorious general," suffered a major setback this week, a rare occurrence in his career. He recorded a massive loss of $4,509 in a single week, giving this top player, known for his accurate judgments and consistent profits, his first real taste of the heavy blow of market failure.

A closer look at its trading data reveals that Fisherman's trading focus this week was highly concentrated, with the core pairs being the Australian dollar/Canadian dollar and the British pound/Canadian dollar. The Canadian dollar was undoubtedly the dominant currency in its trading strategy. The root cause of the losses lies primarily in the Bank of Canada's unexpected interest rate cut last week: according to conventional market logic, central bank rate cuts often lead to currency depreciation, and the Canadian dollar should have experienced a significant decline following this news.

However, the actual market trend exceeded everyone's expectations. The Canadian dollar exchange rate did not collapse as anticipated; instead, it remained range-bound within a narrow range. This sudden market divergence directly caused Fisherman's numerous orders, placed based on conventional logic, to completely miss out—not only did he fail to reap the expected substantial profits, but he also incurred continuous losses due to his flawed directional judgment, ultimately leading to this massive loss. This case once again profoundly illustrates the core characteristic of the financial market: no matter how experienced or accurate one's judgment, it is impossible to completely avoid its inherent uncertainty and unpredictability.

Profile

ROI Volatility

Performance

Want to earn profit just like them?

- Instant Position Update

- Copy their buy/ sell position

- In-sync trading profit

Download TOPONE Markets

Download TOPONE Markets

Get the most profitable trading signals first, 1 million traders have downloaded it, and the average daily profit opportunities exceed 200!

English

English