After the war, recuperate and rebuild

All the best trading leader gather in our community! Let's review their trading dynamics in last week!

Trading Leader Performance

Review

xauusd07

【xauusd07】With 6 trades in a single week and a low win rate of 33%, it managed to secure a profit of $971, barely becoming our 【Profit Star】 of last week.

ROI Ultra

【ROI Ultra】With 2 trades per week, a 50% win rate, and a loss of $13.21, it can be seen that the vast majority of traders adopted a wait-and-see approach to trading last week.

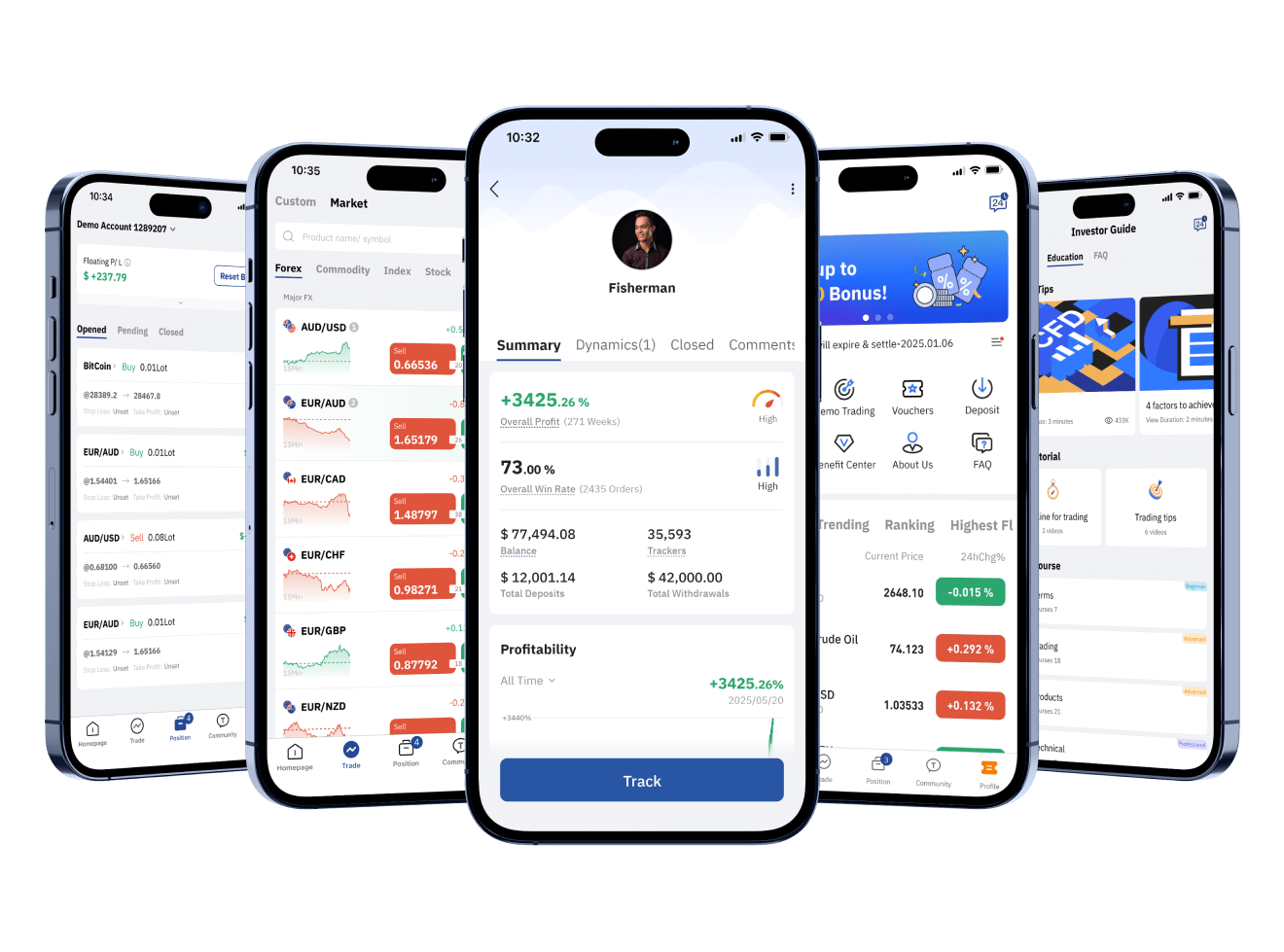

Fisherman

【Fisherman】With 7 trades in a single week and a 43% win rate, he lost $3844, becoming the player with the worst trading data this week, mainly trading the Australian Dollar/Canadian Dollar.

Best Trading Leader

Best ROI

- -- %

Overall Profit

- $ --

Balance

- --

Subscribers

Position

Order Distribution

Assets

Order Revenue/ order($)

ROI

Trading Review

Looking back at last week's trading market, the overall market conditions were volatile, and the trading performance of most participants was far from ideal. The spread of risk aversion in the market directly rewrote the trading strategies of most people.

Faced with a complex and volatile market and persistently rising uncertainty, the vast majority of traders opted for the safest approach: decisively halting active trading. They understood that in a phase of unclear trends and expanding risk exposure, blindly entering the market was tantamount to stepping into an unknown trap. Therefore, they tightened their trading positions and suspended new orders, adopting a "wait-and-see" approach to avoid potential systemic risks. While they didn't achieve profits, they successfully preserved their previous trading gains and kept losses within a manageable range.

In stark contrast, a few aggressive traders attempted to find profit opportunities amidst the market's volatile "fire," hoping to snatch profits from the flames and reap excess returns. However, they ultimately failed to withstand the market's reversal and suffered varying degrees of account losses. Their previous aggressive decisions were proven false by the actual market fluctuations.

Among these, the trading situation of Fisherman is particularly noteworthy. During last week's trading period, his account ultimately recorded a loss of $3,844, a result directly and closely related to his consistent trading style. As a well-known "aggressive trader" in the industry, Fisherman is known for his boldness and decisiveness, especially favoring to enter the market against the trend during extreme market conditions when most people choose to wait and see, hoping to seize a glimmer of profit. This "either make a big profit or suffer a big loss" gambling-style trading logic has allowed him to achieve impressive profits many times through accurate judgment, but it has also destined his account's returns to be highly volatile. This time, he clearly fell into the latter predicament.

Looking at specific trading instruments, Fisherman's operations last week primarily focused on the Australian dollar, Canadian dollar, and British pound, with the AUD/CAD pair being his core trading instrument. The AUD/CAD pair accounted for a significantly larger proportion of his position and was traded more frequently than the other two. Ultimately, most of his losses stemmed from misjudging this pair. Influenced by multiple factors, including the synchronized fluctuations of commodity-related currencies and sudden disruptions in geopolitical economic data last week, the AUD/CAD pair's movement significantly deviated from Fisherman's predictions. Multiple entries at key support and resistance levels failed to trigger profitable moves; instead, the continued reversal of the market trend resulted in substantial unrealized losses, ultimately dragging down the overall account performance.

Despite the significant setback in this trade, Fisherman's past trading experience has demonstrated his potential in market analysis. It is hoped that Fisherman can quickly adjust his mindset, review his trading mistakes, recalibrate his trading strategies and instrument selection logic, reverse his current ranking disadvantage in subsequent rankings, and once again demonstrate the profitability of his aggressive trading style.

Profile

ROI Volatility

Performance

Want to earn profit just like them?

- Instant Position Update

- Copy their buy/ sell position

- In-sync trading profit

Download TOPONE Markets

Download TOPONE Markets

Get the most profitable trading signals first, 1 million traders have downloaded it, and the average daily profit opportunities exceed 200!

English

English